Shipments of Android tablets overtook those of the iPad this holiday quarter. After this surge, I expected all players in the industry to see a major sequential decline in Q1. However, NPD's display shipment data suggests that the full-sized iPad is taking the biggest hit. Let's use this data to revisit our tablet market share projection for Q1.

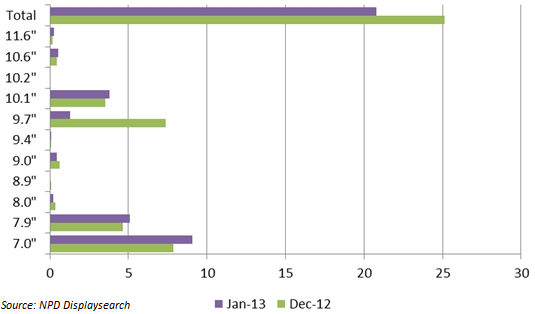

The chart above shows NPD's tablet display shipments estimates for December 2012 and January 2013, by display size. Display shipments are delivered to OEMs as an input to the tablet manufacturing process, so they are a leading indicator of tablet shipments, i.e. displays are likely to be used in manufacturing and shipped in the following month(s). So display shipments in December and January should explain ~70% of tablet shipments in Q1 2013, assuming yield rates remain constant across all tablets.

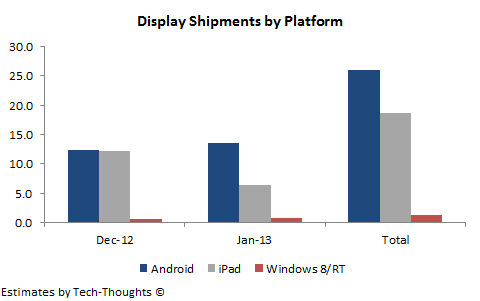

Tablet Display Shipments by Platform

The problem with NPD's data is that it gives us a view of shipments by display size and not by tablet platform. Luckily, OEMs using specific platforms have consolidated around a few popular screen sizes. The full-sized iPad is responsible for the vast majority of 9.7" display shipments, while the iPad Mini may be the only tablet with a 7.9" display. Similarly, most Windows 8/RT tablets are sized at 10.1" and above, while Android tablets make up the rest (Shipments of the 7" Blackberry Playbook can be considered negligible). Since the bulk of Android tablets are sized at 7" and 10.1", Windows 8/RT tablets may be responsible for just 2-3% of 10.1" display shipments based on Q4 figures. This gives us the following shipment pattern by platform:As we can see, iPad display shipments seem to have dropped by about half from December to January. This fall can be attributed to a ~80% drop in shipments of full-size iPad displays. Meanwhile display shipments for the iPad Mini have remained strong. Unless Apple has a new full-size iPad on the way with a 10.1" display, this strongly hints at a collapse in sales because of cannibalization from the iPad Mini. My iPad Mini cannibalization estimate was far more aggressive than others, but actual cannibalization seems even worse.

Meanwhile, shipments of Android tablet displays have remained strong (in stark contrast with Q1 2012). Since developed market sales peak during the holiday quarter, this strongly suggests that emerging market demand for cheaper tablets is picking up. This also explains why shipments of 7" Android tablet displays are growing faster than 7.9" iPad Mini displays. In fact, 7" Android tablet displays (in January) seem to be outpacing all iPad displays (9.7" and 7.9") by themselves.

Tablet Market Share Projection - Q1 2013

Using the data from December & January, we get the following market share split by platform (approximation for Q1 2013):This projection is likely to be somewhat conservative for Android tablets. Display shipments in February are likely to be closer to January's figures, as compared to December, which puts the iPad's market share under even more pressure (although this could be balanced out by a new product launch in March). In addition to this, rising demand from emerging markets is likely to continue to boost Android tablet shipments. Meanwhile, Windows 8/RT tablets seem to be following in Windows Phone's footsteps. Based on these figures, emerging market demand seems to be forcing the tablet market in the same direction as the smartphone market, with Android firmly in the lead.

Follow-Up Post: The Curious Case of the iPad Shipment "Collapse"