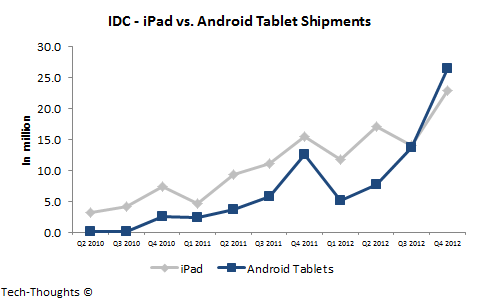

IDC recently released their tablet market estimates for Q4 2012 and I have to say, the figures were surprising even to me. I have been commenting on the similarities between demand patterns in the smartphone & tablet markets for some time now, stating that Android tablets would overtake the iPad by mid-2013. Quite surprisingly, that already seems to have occurred. Let's take a look at the sustainability of this change of guard.

Estimating Android Tablet Shipments in Q4

Let's begin by first converting IDC's shipment figures by OEM to shipment figures by platform. This is usually not very difficult, as the only significant non-iPad and non-Android tablets on the market were the Blackberry Playbook and the HP Touchpad. However, with the launch of Windows 8 and Windows RT based devices, we now need to take them into account as well. We know that the total tablet shipment volume in Q4 2012 was 52.5 million units, of which the iPad accounted for 22.9 million units (incl. the iPad Mini). From Blackberry's results, we know that 255,000 Blackberry Playbooks were shipped in the quarter (a rough guide as the quarter definitions are off by a month). IDC also mentioned that Microsoft Surface RT shipments totaled just 900,000 units in Q4. Combining this with Digitimes' estimate of 2 million shipments of Windows RT based devices, we get a total of 1.1 million shipments of Windows RT devices, excluding the Surface RT - we can add another 0.9 million shipments of Windows 8 based tablets (given the widely reported lack of availability). Excluding the Blackberry Playbooks and Windows based tablets gives us a total of 26.4 million Android tablet shipments, for 50.4% of the market.As I had predicted, while the iPad Mini helped boost iPad demand, it did nothing to slow down the ascent of Android tablets. Android tablets have now outpaced the iPad's sequential growth in 6 out of the last 8 quarters and I expect this general trend to continue.

Impact of Emerging Market Demand on Q1 Shipments

As we saw last year, tablet shipments usually see a steep decline in Q1. This is driven partly by weaker sequential demand and partly by inventory build-up into the channel. Kindle Fire shipments shrank by more than 85% sequentially because of an inventory build-up, while demand seasonality caused shipments of all other Android tablets to shrink by 44% (shipments of Samsung & Asus devices shrank by 20% and 40% respectively). This seasonality in demand was driven by the holiday season in the US & Europe, which were the core market for tablets. Demand in emerging markets tends to be less seasonal, so as emerging market demand grows, seasonality should reduce. More importantly, mature market focused OEMs should see greater seasonality of demand (primarily Amazon, B&N and to an extent, Apple).

At this point, since we don't have much data to accurately estimate the impact of emerging market tablet demand, my estimates can be considered conservative. New low cost offerings from various Android tablet OEMs (primarily Samsung, Acer, Lenovo, Asus) could change demand patterns and nullify seasonality to an extent.

iPad - I expect iPad shipments to shrink by roughly 20% (slightly better than Q1 2012) to ~18 million units, as any delayed iPad Mini purchases are likely to be balanced out by shrinking demand for the full-size iPad. In addition, the iPad Mini should see stiff competition from lower priced devices in emerging markets.

Amazon - Kindle Fire shipments are likely to see the largest drop, by about 60%, to ~2.5 million units - I've considered a smaller drop this time as initial launch-driven channel filling occurred in Q3, as opposed to Q4.

Samsung - Samsung tablet shipments should fall by 20% (in line with Q1 2012) again to ~6 million units. Samsung's marketing muscle could help minimize the impact of demand seasonality.

Asus - I've forecasted a 20% decline in Asus' shipments as well, to about 2.5 million units. This is because Asus already seems to have shipped 6 million Nexus 7 tablets until the end of January (the count was 5 million at the end of Q4). So if Asus has shipped ~1 million Nexus 7 units in January, another 1.5 million total tablet shipments in the quarter seems fairly reasonable.

Other Android Tablet OEMs - I've considered a 40% decline in shipments of other Android tablet vendors (incl. Acer & Lenovo). These vendors saw a sequential decline of more than 50% in Q1 2012, but stronger emerging market demand and lower cost offerings should help them hold on. I consider this segment to be the most sensitive to emerging market growth.

Windows 8 & Windows RT Tablets - Given the low sell-through rate and high returns seen in this segment, I see a sequential decline in shipments. The price of the Surface Pro should do nothing to stimulate demand.

This puts the total shipments of Android tablets at ~17 million units, about one million units less than the iPad. However, I expect shipment growth of Android tablets to continue to outpace the iPad after Q1, resulting in a permanent change of guard. Of course, greater than expected emerging market demand could put Android tablets firmly in the driver's seat in Q1 itself.