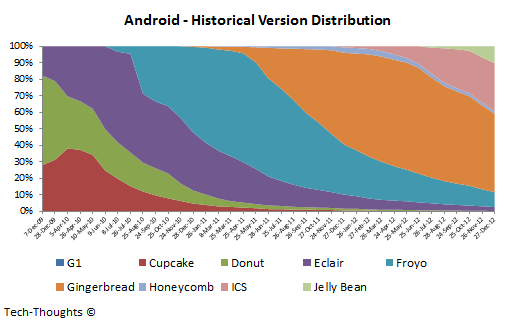

When Google released Android 4.1 Jelly Bean, just 6 months after the major 4.0 (Ice Cream Sandwich or ICS) update, I expected a negative impact on Android fragmentation. Interestingly, Android 4.1 adoption seems to be ahead of schedule, with ICS adoption seems to be lagging, when compared to Android 2.3 (Gingerbread). Let's take a look at the reasons for these adoption patterns.

Before we begin, let's take a look at the Herfindahl Index (defined in my original Fragmentation analysis) to understand the current state of fragmentation:

As per the chart above, fragmentation has taken a turn for the worse after Jelly Bean's release. The H-Index is currently at its lowest level since mid-2010, when FroYo and Eclair were the dominant versions. In order to understand the cause of this dip, let's take a look at the adoption trends of the last 3 major Android versions, i.e. Gingerbread, ICS and Jelly Bean:

As we can see above, Jelly Bean adoption, at this stage, seems to be ahead of the pace of both Gingerbread and ICS. This means the root cause of the drop in the H-Index is the weak adoption seen by ICS (at just 29%, as compared with 48% for Gingerbread, after 12 months). This is likely related to the fact that ICS was the most significant update to hit the Android operating system, which made it incredibly challenging for OEMs and carriers to incorporate with their skinned version of Gingerbread. However, once customized versions of ICS were ready, it was easier to incorporate Jelly Bean, as it was a more incremental update.

Also, the chart above shows a noticeable slowdown in ICS adoption after about 9 months, while Gingerbread was unaffected. As this slowdown begun after the release of Jelly Bean, it was most likely caused by ICS devices being upgraded.

One understated factor that could drive the upward cycle of the H-Index is Google's move to a semi-annual, major-minor release cycle, i.e. Google may stick to an annual schedule for major Android releases, followed by a minor release 6 months later (e.g.: Android 4.1 followed by Android 4.2, both christened Jelly Bean).