Estimating iPad shipments for Q4 is essentially a 3 step process:

1) Estimating hypothetical iPad shipments in Q4, assuming the iPad Mini was never launched

2) Estimating supply constrained iPad Mini shipments

3) Applying the iPad Mini's cannibalization estimate on the above two figures to arrive at a total shipment estimate

Hypothetical iPad Shipments in Q4 - No iPad Mini Launch

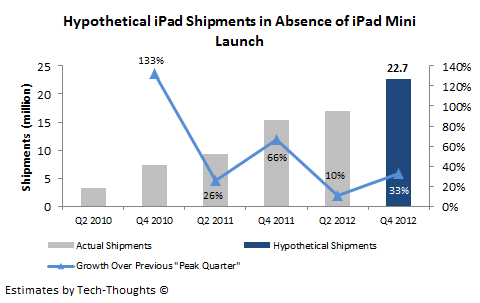

In order to estimate hypothetical iPad shipments in Q4, we need to eliminate any possible impact the iPad Mini may have on the analysis. Since, Q3 figures have already been contaminated by rumors of the iPad Mini, we cannot take them into consideration for estimating hypothetical shipments. Instead, we can look at the iPad's historical growth over alternate quarters. Since its launch, the iPad has traditionally had two strong growth quarters (or "peak quarters") during each product cycle: calendar Q2 (due to the iPad launch schedule) and calendar Q4 (holiday quarter). Let's take a look at the iPad's shipment growth patterns over these peak quarters:As we can see, Q4 has traditionally been the iPad's strongest quarter. The chart also shows that this growth has slowed as shipments have grown and that the estimated growth for this holiday quarter (over Q2 2012) should be about 30-35%. This gives us the following estimate for hypothetical shipments for Q4 2012:

The above chart shows that iPad shipments would have reached 22.7 million units in Q4 2012, if the iPad Mini was never launched.

iPad Mini Shipment Estimate - Based on Supply Constraints

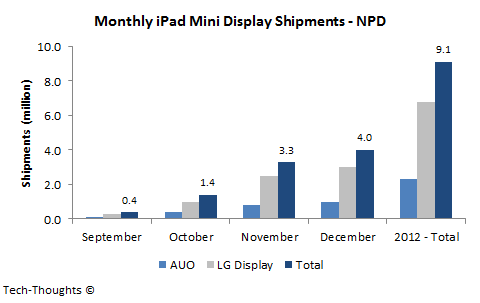

There have been numerous reports from supply chain sources that the iPad Mini's display has been in short supply because of yield problems at AUO Optronics, a new supplier for Apple. Here are NPD's estimates for monthly iPad Mini display shipments:The chart above shows that less than 10 million iPad Mini displays are to be shipped to manufacturers by the end of 2012. However, this does not mean that the same number of iPad Mini units will be shipped over the same timeframe, as we need to take into account the time taken for manufacturing & shipping to retail locations. This is called "cycle time", a concept I used while estimating Nexus 7 sales. Since most early stock out reports for back-ordered iPad Minis quoted a shipping time of 2-3 weeks, the cycle time would most likely fall within the same range. Using these figures, we can get the following estimate for iPad Mini shipments:

Based on the display shipment data above and a cycle time of 2-3 weeks, Q4 iPad Mini shipments should total roughly 6-7 million. The cannibalization estimates in the chart above are based on cannibalized latent demand from Q3. Actual cannibalization is likely to be in the same ballpark, but could vary slightly based on availability of the product to meet demand and greater consumer awareness about the iPad Mini.

Total iPad Mini Shipments - Q4 2012

We have already calculated that hypothetical iPad shipments would have totaled 22.7 million units and that iPad Mini shipments should reach 6-7 million units in Q4. The latent demand calculation also shows that, 50-70% of iPad Mini would be via cannibalized iPad sales. Now, putting these figures together, we can get an estimate for total iPad shipments:The chart shows that, depending on cycle time and actual cannibalization, iPad shipments should total between 24-26 million in Q4 2012, i.e. 18-19 million regular iPads (3rd/4th Gen iPad & iPad 2) and 6-7 million iPad Minis.