With the iPhone 5 launch in the rear view mirror, numerous analysts have chimed in with their Q4 and full year iPhone sales estimates. Unfortunately, a lot of these estimates seem quite unrealistic given the market realities I talked about in my last post. Let's take a deeper look at iPhone sales patterns and see if we can come to a more reasonable estimate.

As I mentioned in my previous post, I expect the iPhone 5 to drive a blowout Q4 for Apple. Most analyst estimates for Q4 iPhone sales seem to be hovering around the 50 million mark. While I think we'll have a better idea of that number when Q3 results are announced, that seems to be a fairly reasonable estimate. However, quite a few analysts have also predicted roughly 250 million total iPhone sales over the next four quarters and that's where the problem lies.

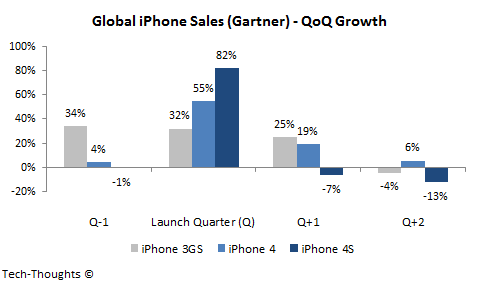

iPhone Sales - QoQ Growth During & After Product Launch

Let's take a look at the iPhone's Quarter-on-Quarter (QoQ) shipment growth figures, based on Apple's results, for the past three iPhone launches:

Apple typically launches a new iPhone model near the end of a quarter to help minimize the pre-launch slump in quarterly sales. In the chart above, I've considered the Launch Quarter (Q) to be the first full quarter of new iPhone sales. The most obvious observation from the chart is that QoQ growth spikes during a launch and tails off in the following quarters. More importantly, the chart shows that with successive iPhone launches, demand seems to be more and more concentrated in the launch quarter, with following quarters seeing weakening demand. Before diving into the underlying reasons for this pattern, let's take a look if the same pattern is seen in iPhone sales as well:

The chart above is based on Gartner's quarterly smartphone data, as it tracks sales to end consumers and not shipments. The sales pattern is slightly more normalized as compared to the shipment pattern, i.e. sales seem to be slightly more spread out than shipments are. However, the basic pattern seen across successive iPhone launches is the same. With each successive launch, more demand seems to be focused on the launch quarter and there is a significant decline in demand in successive quarters. Also, there seems to be a large drop between QoQ Growth in following quarters for the iPhone 3GS/4 vs. the iPhone 4S.

Underlying Cause of iPhone Sales Growth Pattern

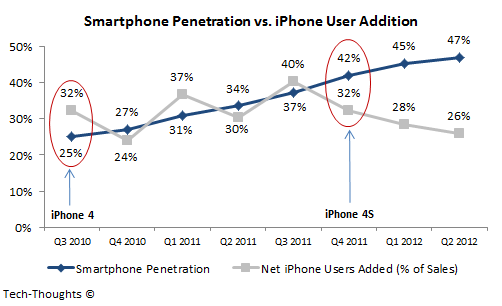

The primary reason for this pattern is that iPhone sales are concentrated in developed markets, which have seen rapidly rising smartphone penetration. In order to verify this, we need take a look at how smartphone penetration has affected iPhone user addition (as a proportion of sales) in the US market:

Smartphone penetration & absolute net iPhone user addition figures have been reported by Comscore. US iPhone sales have been estimated based on Gartner's smartphone data and the assumption that Apple's region-wise revenue split approximately reflects the iPhone's region-wise sales split. Based on this, any errors would be evenly spread across all data points and will not affect the pattern itself.

The chart above shows that the proportion of net iPhone users added have seen a sharp decline as smartphone penetration has exceeded 35%. Since the percentage of "iPhone users added" peaked before the launch of the iPhone 4S, it is unlikely to have been caused by the product launch. Therefore, the most likely cause of the QoQ growth patterns in the charts above is that a rising proportion of iPhone sales have come from existing iPhone owners upgrading their devices and fewer customer acquisitions. Since this pattern would affect all smartphone players in the US market, it is unlikely to affect market share, but it would have a major impact on absolute sales & growth figures.

It is important to note that this pattern would not only affect the US market, but all developed markets with high smartphone penetration, including large European markets and Japan. The only other trigger for a sharp jump in iPhone sales would be a deal with China Mobile over the next year. However, based on compatibility issues and other issues in China, such a deal seems unlikely in the near future.

iPhone Sales Estimate

Assuming the post-iPhone 5 launch QoQ growth rates to be the same as that for the iPhone 4S and a 50 million Q4 sales estimate, the full year sales estimate comes out to about 170 million. However, if we take into account the trend of declining post launch QoQ growth, we get an estimate of 150 million. Based on the available data, 150-170 million seems to be the most realistic estimate for iPhone sales over the next four quarters, far below the 250 million figure that some analysts seem to be banking on.

Conclusion - QoQ growth patterns of recent iPhone launches and the impact of rising smartphone penetration show that analyst estimates for full year iPhone sales are quite unrealistic. Based on the figures above and a 50 million estimate for total Q4 iPhone sales, 150-170 million is a far more realistic estimate and still quite impressive.